If you work for a bank or any other financial institution, then you are very well aware of the fact that IFRS is a little bit different there.

OK, not quite like that: IFRS is still the same, just the way how you use it is a bit different.

Unlike product-based and other service-based companies, banks work basically with money itself.

For other types of companies, money is mostly only the mediator of their transactions and most goods or services do not revolve around money.

In other words, money transactions – like having a bank account – are “supporting” transactions to the main business line.

But the main product or service of any bank or a financial institution (let me just call them “banks”) is money in various forms:

As a result, the financial reporting of banks’ activities looks pretty different from what you would expect based on “normal” company.

In this article, I would like to outline the main specifics of the IFRS use by banks and the IFRS standards that are top priority for any CFO, accountant or a finance person working in banks and financial institutions.

We will look at 3 hottest IFRS topics for the banks and financial institutions.

If you are working in a bank, then the standards about financial instruments are absolutely a MUST for you.

Of course – money is a financial instrument itself!

Financial instruments are very complex and involve lots of considerations and topics. Not only banks face financial instruments – any trading company has some financial instruments, too (if selling and invoicing).

The truth is that banks enter into many complicated transactions, issue various types of compound financial instruments (in which both equity and liability element is present, e.g. convertible bond), generate loans to different portfolios of clients with different credit risk and many others.

Within the financial instruments, the hottest issues are as follows:

The impairment of financial assets as introduced by IFRS 9 in July 2014 brings many big challenges especially to banks.

In brief: IFRS 9 introduced expected credit loss model for recognizing loss allowance to financial assets. And banks are affected severely.

Majority of other types of companies can use simplified approach permitted by IFRS 9 for the impairment of financial assets and calculate loss allowances solely in the amount of life-time expected credit losses.

However, banks cannot use simplified approach for the biggest group of their financial assets – loans, because the loans do not fall within the exception.

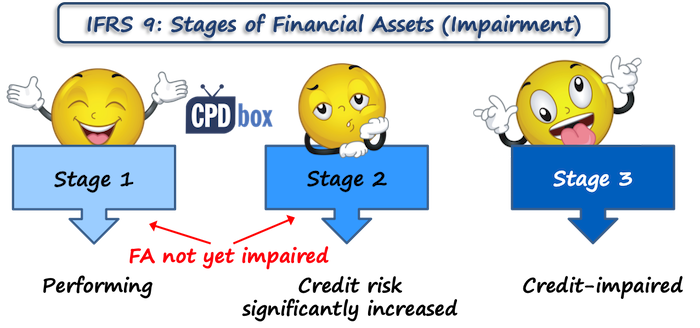

Banks need to apply 3-stage general model for recognizing loss allowances.

It means that banks must:

All these tasks bring significant tasks for IT department, account managers dealing with the clients, statistic people and many other involved in order to upgrade the internal systems, so that all the information is provided on time and in sufficient quality.

Not an easy task!

Financial assets make up most of banks’ assets.

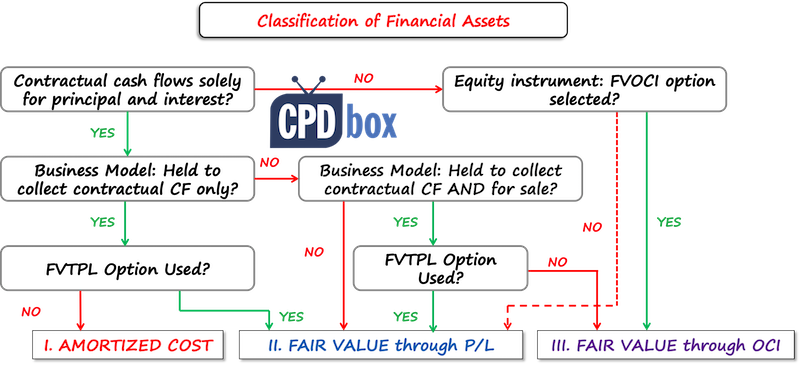

Currently, standard IFRS 9 classifies the financial assets based on 2 tests:

Based on the assessment of these tests, the financial asset can be classified either as measured at:

The banks and other financial institutions, mainly companies trading securities, investment funds and similar entities, need to dedicate their time and effort in order to analyze their own business model for individual portfolios of financial assets (Trading? Collecting cash flows? Both?), and then decide on their classification and measurement.

Regardless analyzing the 2 tests above I’d like to stress here, that every single financial asset and liability needs to be initially recognized at its fair value (well, sometimes you add transaction cost).

Here, the standard IFRS 13 Fair Value Measurement comes to the light. This standard sets principles for determining the fair value and therefore, it becomes very important in the financial reporting of any bank.

Banks enter into various contracts and transactions related to money and financial instruments – we have already said that.

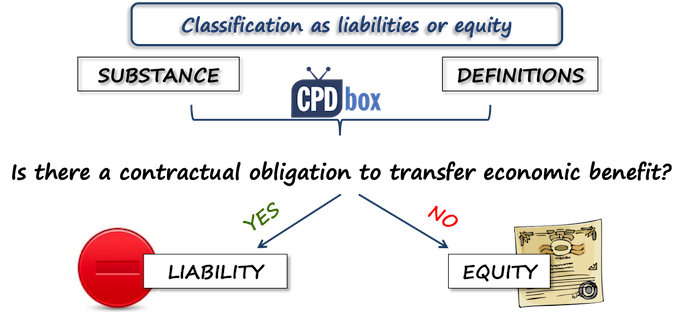

Thanks to complexity and diversity of banks’ operations it might be demanding to classify correctly whether the bank’s instrument is equity or liability, or even a mixture of both.

The standard IAS 32 Presentation of financial instruments gives us more precise rules on how to correctly distinguish between these two types of instruments and this becomes particularly hot in banks.

Because incorrect identification of equity/liability/mix can lead to wrong presentation of bank’s financial results including various rations assessing bank’s capital and financial situation.

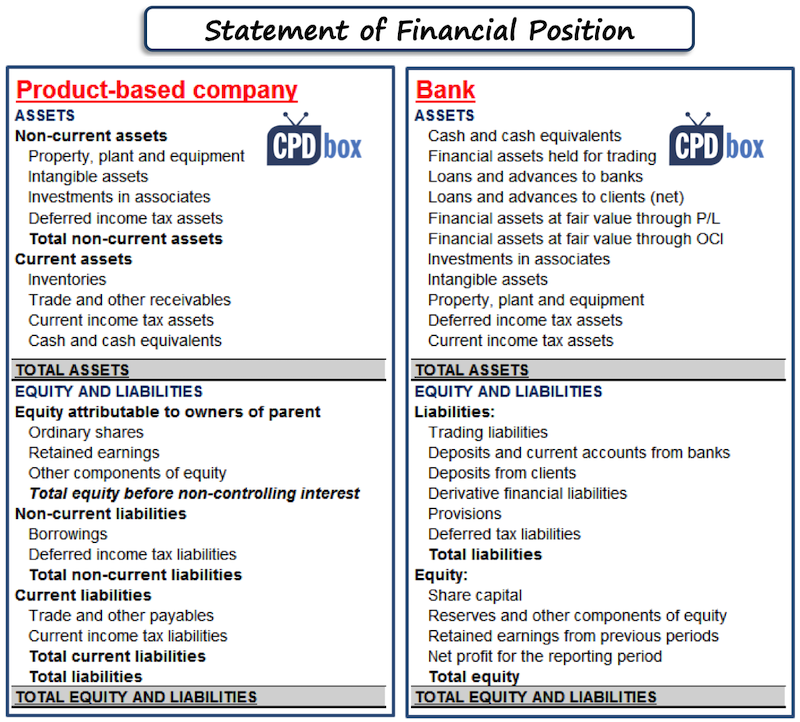

Banks present their financial position and financial performance in totally different way than other companies.

Let’s break it down.

The standard IAS 1 Presentation of Financial Statements does not prescribe the format of the statement of financial position – however, it brings some examples of accepted formats.

As soon as you include items mandatorily required by IAS 1, you are OK with your selected format.

When you look at the statement of financial position of any bank, you will not see the balance sheet that you are used to in other types of companies, starting with non-current assets (property, plant and equipment, intangibles), followed by current assets (inventories, receivables, cash), and then the second part starting with equity, non-current liabilities finishing with current liabilities.

What you would see instead is the statement in which individual items are ordered by their liquidity, starting from the most liquid assets, finishing with the least liquid ones. The equity & liabilities part corresponds with the assets – it starts with the current liabilities in a descending order of liquidity and finishing with equity.

I have said it several times by now: money is the key. When you look to bank’s financial statements, you want to see how much money and liquid asset it owns rather than how many buildings and computers there are.

In other words – liquidity order is much more relevant for banks.

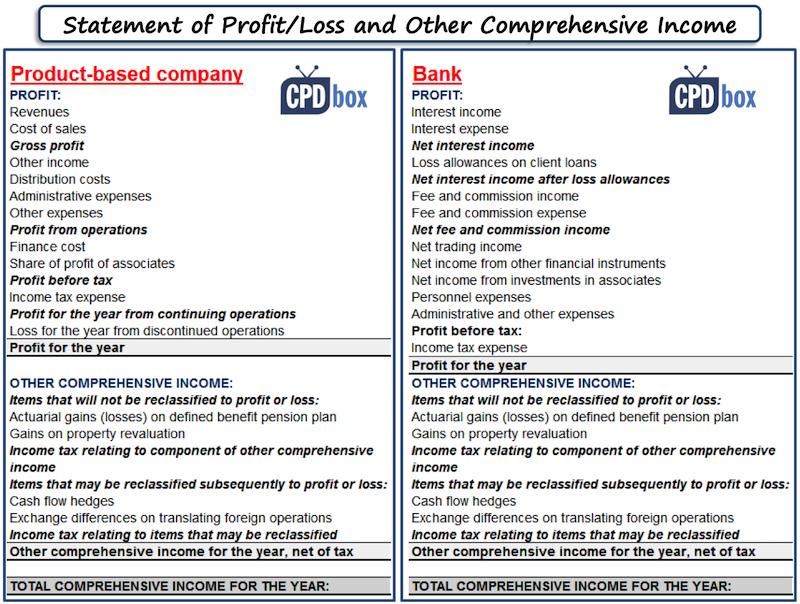

Similarly as with the statement of financial position, IAS 1 does not prescribe the exact format of the statement of total comprehensive income.

It is up to entity’s choice to present its results in a format fitting the best the entity’s business.

No surprise that banks’ statements of profit or loss and other comprehensive income usually start with interest income and interest expenses!

Normally, you would expect to see the interest reported somewhere close to the end of the statement, in the financial operations, and often netted off.

However, interest income and expenses are the most important caption for the bank as that’s what banks usually do – they deposit your money and give you the interest (=their interest expense) and they lend you money + charge you the interest (=their interest revenue).

As the banks usually charge you some fees for your bank account, fee and commission income follows (just a side note – as the interest rates are quite low right now and fees are climbing the roof, I just wonder when the fee and commission income goes in the top line before interest).

We can continue, but the main principle here is to present the most important revenue – generating activities at the top.

For your illustration, here’s the comparison of 2 statements of profit or loss and other comprehensive income -1 for a product-based company and 1 for a bank:

I am going to repeat myself a bit. Money rules in the banks and therefore, cash flow statements look different.

When you prepare the statement of cash flows, you normally classify individual cash flows into 3 parts:

Although IAS 7 Statement of Cash Flows gives you examples of items reported under each heading, this basically does not apply for banks.

The reason is that the bank’s principal revenue and cash flow generating activities are totally different from other companies.

Therefore, while you normally see interest paid in financing part and acquisition of securities in investing part, for banks all these activities are reported in operating part. We can continue like that with the other items too: including profit from trading activities, etc.

On top of disclosures presented by other non-financial companies, banks must present a number of other disclosures related to their activities.

The most important disclosures are:

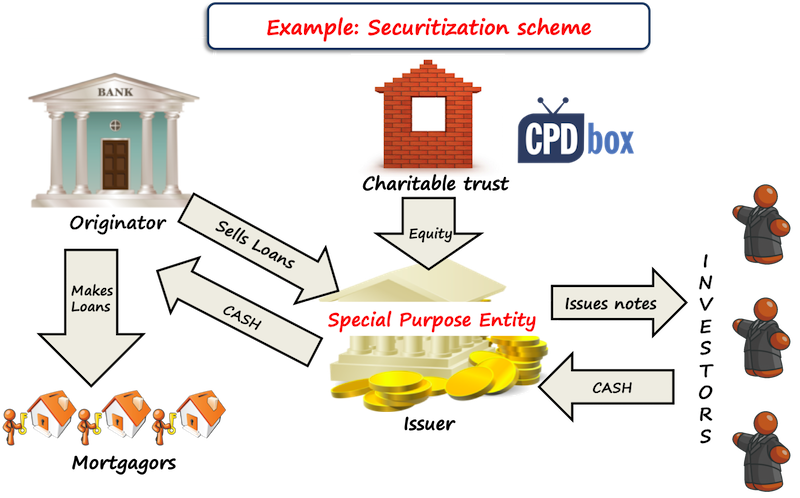

Banks love to use special purpose entities.

Before some time, it was a “great and creative” way of hiding some undesirable or toxic assets from the eyes of public, as the special purpose entities were usually not included in the consolidation (understand: no one saw them).

However, after a few accounting scandals (for example, Enron), there were new and strong rules adopted. In IFRS, we have the standards IFRS 10 Consolidated Financial Statements and IFRS 12 Disclosure of Interests in Other Entities, that require inclusion of structured entities in the consolidation when they meet the conditions (basically, when banks has control over SPE).

Even today, many banks use literally hundreds of SPEs for various purposes, mostly for securitization of their loan receivables, holding some tax-efficient leases, for asset-backed financing, etc.

Example of securitization scheme:

The bank needs to evaluate very carefully whether they control structured entity using the same methodology as for any other entities controlled by voting rights.

As a result, you can see lots of entities including in the bank’s consolidated financial statements.

Other critical areas for banks and financial institutions to watch out are mostly the same as for any other company, but they might be more significant and material:

I know this list is not exhaustive, but I hope that I gave you at least some hints and intro into the complex topic of IFRS accounting in banks.

If you liked this article, please share it with your friends and if you have experienced other specific situation in a bank or a financial institution you work for, please share it with me and other readers below in the comments. Thank you!